MARPOL 2020 and Africa

CITAC studies the impact on refiners, shipping and the bunker supply chain of the introduction of global low sulphur bunkers for shipping.

CITAC Africa has just published a client Industry Insight paper on the IMO’s MARPOL regulations due on 1st January 2020, with a focus on African fuel oil flows and typical product quality.

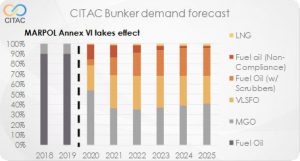

The Insight offers CITAC’s global forecast bunker demand by product post 2020:

And states that the key variable is certainly the level of deliberate or accidental non-compliance where we are projecting 15% in 2020 while others are mentioning numbers as high as 35%. The IMO is currently talking tough on enforcement; we have to wait and see how this will work out in practice.

Impact on refiners

For refiners, the Insight Paper states:

- There is no economic logic in investing heavily in de-sulphurising fuel oil (although Japanese and Korean refiners are considering this option) since you are investing in converting one product that has a lower value than crude oil, to produce another that is also forecast to become, fairly quickly, also less than the price of feedstock;

- It is far more economic to put that capital towards upgrading the fuel oil to distillate, which will continue to reward the refiner with a high premium over crude oil;

- 50% sulphur fuel oil availability will likely be limited to current volumes plus marginal improvements due to a sweeter crude slate, if the incremental margin is not eaten up by changing crude oil price premia (the price of crude will match the increase of product yields);

- Some zombie refineries may reawaken to take advantage of market opportunities: e.g. Wilhelmshaven in Germany to optimise its high VGO yield either into the low sulphur bunker market or to traditional cracker feed, and Hovensa at St. Croix in the Caribbean which is looking to optimise US, Venezuelan and South American crudes to meet regional low sulphur bunker demand.

The result of this likely logic, and the actions it would lead to, is that fuel oil production will drop after 2020 unless there is a substantial increase in refinery crude throughputs – which would require a major improvement in refinery margins to encourage such action. The fuel oil displaced will be converted into distillates.

From theory to practice in Africa

The South African and Egyptian refineries will not benefit from MARPOL 2020 but will instead have to search for lower value high sulphur export markets. CITAC’s expectation is that South African refiners will sweeten their crude slate and produce limited amounts of compliant bunker fuel. Their investment priority will be to invest first in cleaner road fuels while hoping that scrubber uptake helps the high sulphur market recover quicker than expected.

For Egypt, EGPC will be hoping that the new ERC (upgrading) units in Cairo will start up soon to remove some high sulphur fuel oil from the market. In Suez, CITAC expects that EGPC will lower crude throughput in the short term to balance fuel oil exports, including high sulphur bunkers, depending upon refinery margins. During this period, when new refinery projects are being evaluated, Egypt will continue to import high quality transport fuels from the Saudi Arabian exporting refineries on the other side of the Red Sea.

David Bleasdale, CITAC Executive Director – October 2018

Purchase this Industry Insight