Why 2018 may be as wild as 2014

The discovery of a leak in the North Sea Forties Pipeline in December 2017 set the cat among the pigeons for global oil markets in more ways than one.

For the unexpected loss of almost half a million barrels of crude is emblematic of a situation that has analysts and forecasters scratching their heads when it comes to predicting where prices will go next. Until mid-year 2017, a lot of forecasting reputations had been staked on the “conventional wisdom” that market fundamentals were at heart bearish, and that OPEC’s attempts to shore up prices by cutting output were doomed to fail. OPEC cuts would simply be replaced by new tight oil production from the USA.

Then the Brent market moved in July from contango to backwardation (where prompt crude is pricier than cargoes available farther down the forward curve). And suddenly the situation looked rather different.

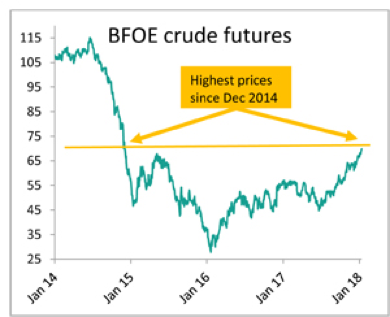

A whole slew of factors has conspired to keep crude prices on an upward track ever since, and benchmark BFOE is now flirting repeatedly with $70/bbl or higher.

In this Insight article, we examine what those factors are Wordlwide, whether they mean prices could go even higher, or whether – as the bearish keep telling us – the whole supply tightness and demand growth story is about to come unraveled.

by Neil Fleming, January 2018

Purchase this downstream insight