The African retail sector: Challenges & opportunities

The oil product retail sector in Africa has undergone big changes over the course of the past 20 years. The industry was initially dominated by the retail arms of International Oil Companies such as Shell, Chevron, Mobil and Total – but virtually all of the original players have since departed the African retail sector. Why has this been the case? In most cases, the publicly listed nature and size of these companies meant that the risk involved in operating in African retail and distribution networks simply outweighed the benefits to be gained.

The vacuum left by the majors’ withdrawal was quickly filled by a mixture of local companies and agile trading companies looking for new opportunities. African combined gasoline and gasoil demand has grown 25% between 2010 and 2017 thanks to strong fundamentals: Sub-Saharan African GDP growth, which averaged 4% between 2010-2017 is forecast to average 3.7% over the next decade while population growth, another key driver of demand, is forecast to grow 2.6%/yr over the next decade rising by a third to 1.3bn citizens in 2028. Furthermore, the urban share of population is forecast to increase from 39% currently to 42% over the period, leading to greater per-capita consumption.

Strong African demand growth provides an enticing environment for efficient marketers with a thorough understanding of the different aspects of the African retail sector and robust risk management capabilities. Indeed, many markets on the continent are now dominated by either traders’ part- and fully-owned retail subsidiaries (Puma, Vivo, OVH, Redan, Zuva) or indigenous companies taking over majors’ former assets (NOC Ethiopia, Tradex, MRS), while a few of the original majors remain active (Total, BP, Chevron). As the landscape shifts and more players seek out margins further down the supply chain in a crowded trading environment, more and more companies are evaluating opportunities onshore.

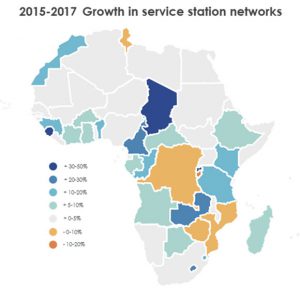

According to CITAC data, service station counts reached 35,000 sites across the continent in 2018, up 7% from 2015. With further expansion of the sector a given, this paper aims to highlight the challenges associated with the African retail sector and the successful strategies employed.

Jeremy Parker, CITAC Consultant – July 2018

Purchase this Industry Insight