How do you assess investing in African refining?

Any investment in the petroleum refining business, which is typically capital-intensive and prone to market volatility, has to be made with a long-term view, perhaps in excess of 20 years. So, whether planning to refine their own crude or to import from elsewhere, African countries must nurture conditions favourable for the development of robust, sustainable and competitive domestic oil refineries.

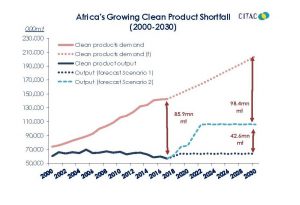

As Africa has become one of the world’s fastest growing markets for refined petroleum products, some commentators lament the failure, or half-hearted efforts, of African attempts to develop sustainable local downstream industries, particularly oil refining capacity. Because of this, they argue, the continent has been ‘losing’ billions of much needed dollars in potential revenue as Africa exports 8% of the world’s crude oil production, while importing all its incremental clean product demand.

Currently, overseas refineries meet around 66% of Africa’s 4mn b/d of oil product consumption. CITAC forecasts demand to rise by around 300,000 b/d by 2020 – limited refining capacity additions mean that much of this incremental demand will be met by direct imports.

In order to move away from this ever-increasing trend of product imports, governments need to concentrate on establishing the necessary enabling economic and regulatory environment to nurture sustainable domestic petroleum refining capacity.

This article identifies the key issues that need to be resolved before any potential investor can be confident to move forward with sponsoring any African refining project, whether in a new plant or upgrading an existing one.

David Bleasdale, CITAC Executive Director – April 2018

Purchase this downstream insight