The Present and Future of African Fuel Retail

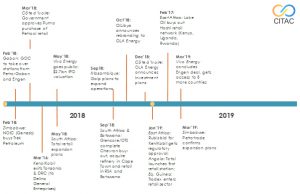

The end of the mass-sale of the majors’ assets left space for smaller players and adjustments only. But fast-growing markets, driven by demand for transport fuels, vehicle fleet growth and population and urbanisation trends, opened opportunities for organic and small-scale inorganic (i.e. via acquisitions) growth of existing players and new entrants. This, in turn, resulted in a new wave of consolidation of assets opening the way in for more large and small international trading companies (e.g. Glencore, Mocoh) and investors’ participation (e.g. Sahara, Vivo IPO).

In addition to this, state oil companies continue to show keen interest in taking part of this fast-growing sector, e.g. BOL in Botswana, Namcor in Namibia, EPSE in Ethiopia, GOC in Gabon, T-Oil in Togo, Genesis (NOIC) in Zimbabwe, Nocma in Malawi, etc.

The Future

There is still an opportunity, left open by exiting players or consolidation strategies of remaining players resulting in resale of existing assets. These opportunities may allow existing players and new entrants to enhance their positions and increase market shares. But more importantly, the overall market growth prospects will provide an even greater opportunity for volume growth and increase in revenue. For the first time, the African marketing and retail sector is seen as an attractive investment for private equity and other international capital, as demonstrated by the IPOs, sales, and mergers and acquisitions that have already taken place over the past couple of years.

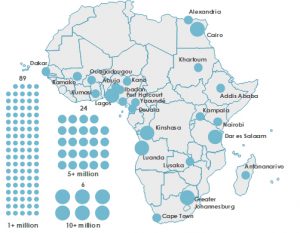

Urbanisation, technology, rising incomes, political stability and better governance are all significant reasons why businesses should prioritise Africa over other regions of the world. Africa has the potential to be the world’s next great growth market.

African cities by population in 2035, millions of people

Some existing challenges will persist into the future, including infrastructure, electricity supply, high operating costs in rural areas, and price and margin regulation. Retailers faced with tight margins typically seek to supplement fuel sales with non-fuel sales.

But fundamentally, fuel retailers and customers are transitioning fast:

- Rapidly growing and urban middle class with increasing car ownership leads to increased throughput at service stations;

- Goods and people move primarily via roads without viable alternatives and increasing industrial output and demand is driving increased commercial vehicle usage;

- Large and increasing potential for development of non-fuel retail offerings, e.g. restaurants, cafés, car washes, garages, ATMs, other services (e.g. Vivo expanding partnership with KFC);

- Increased importance in the non-fuel retail offer as means of brand differentiation;

- Shift of business focus from fuel retail customers and market share to commercial/non-fuel retail customers;

- Digitalisation of the forecourt (e.g. loyalty cards, move away from cash transactions on to cash-less payment), back-office operations, advertising (e.g. customised advertising, tailor-made offers);

- Increased competition for margins, technology-driven supply chain optimisation strategies;

- A shift from safety being the primary concern at present, to the full spectrum of HSSE.

Elista Georgieva, Executive Director – July 2019

This is an extract of the Insight Paper published in CITAC’s Sub-Saharan Africa Oil Market Report (July 2019)

Purchase this Industry Insight