The Future of Refining and Storage in South Africa

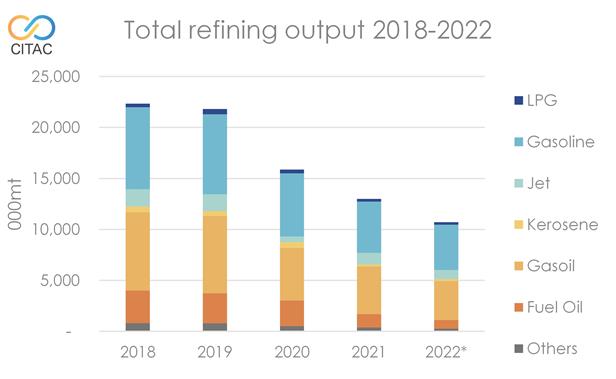

The refining sector in South Africa has changed significantly in the past five years. In 2018, South Africa’s refineries produced 21.8mn mt of products and in 2022, this is forecast to be only 10.9mn mt.

The impact of Covid-19 is a factor in the reduced production in 2020 and 2021. The main reasons for the severe decline are, however, the closure of the Engen Refinery, the lack of gas or economically viable condensate feed to run the PetroSA refinery, and the explosion at the Astron Refinery in mid-2020. Engen had announced its plans to close the refinery in 2023, but came down earlier than planned in December 2020 due to a fire. Astron is due to restart in Q3 of 2022.

Most recently, another very significant development in the refining sector is that Sapref’s owners Shell and BP announced that unless a buyer could be found for the plant, it would suspend indefinitely all refining operations before the end of March this year. At time of writing, it appears that the refinery did indeed stop running in late March. Further to that, the Sasol CFO has described the upgrades needed to make Natref CF2 compliant as “sub-economical”, and the company’s CEO has said that a long-awaited decision around the refinery’s future will be made by the end of Q3 2022.

CITAC Industry Insight is published in CITAC’s Sub-Saharan Africa Oil Market Report April 2022.