Managing the refinery risk of price volatility

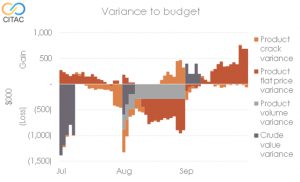

Living with the risk of daily oil price volatility on both crude oil and products is part of the life of any refinery. While margin risk can—and has—forced many refiners out of business, the process is generally a slow one. Flat price risk, on the other hand, is potentially far more lethal as a decision to purchase and price a cargo of crude oil as the oil price collapses could well bankrupt a refinery and destroy its ability to sustainably finance future operations.

Shareholders and senior management must make a clear, mandated, decision to either accept price risk as part of business operations or to put daily robust, rigorous systems and processes in place to first of all measure the risks, and second to manage them within financial and commercial constraints.

In fact, CITAC would argue that even if the shareholders’ decision is NOT to manage the risks, but to accept them as part of being a refiner, there is still a manifest obligation that management monitor the risks. This obligation comes from the need to protect the shareholders’ investments (whether state or private).

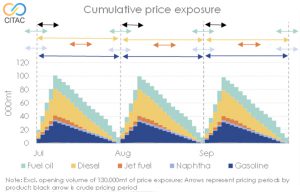

Even where management opts not to hedge, a price risk management system can still be used to change pricing policy so as to mitigate the risks. Once a daily limit of exposure has been set by the refinery management and endorsed by the shareholders, a Daily Volume Exposure Report to senior management can show the refinery’s daily exposure to product price movements.

The system can be used to look back, but more importantly, forward at the refinery’s risk exposure and quantify the level of price risk being taken as any given month progresses. Management attention will thus move towards managing and trading risk (through controlling price exposure through timing and selection of pricing dates on both crude purchase and product sales both to inland marketing sales and bulk/export, and their dates of lifting) rather than merely haggling over deal prices.

This is an extract of the Insight Paper published in CITAC’s Sub-Saharan Africa Oil Market Report (July 2020)

Purchase this Industry Insight