Crude Oil Pricing in West Africa

Crude trading in West Africa has been battered over the past five years by shifts in trade patterns, low oil prices and now by rapidly changing relative values for crudes as new IMO rules for bunker fuels loom.

First, the rise of US crude production – the light, sweet boom caused by shale exploitation – wiped out the main traditional market for West African crude in under two years. Then collapsing oil prices squeezed differentials and made a thorough understand of freight market dynamics imperative for anyone selling crude out of the region. In 2019, another shift is underway, as Angola’s and other ultra-sweet medium-to-heavy crudes rocket in value versus their competitors, driven by the shipping industry’s need to switch to low Sulphur fuels by next year, in order to comply with IMO rules.

Amid such turmoil, now more than ever, it’s important to understand how the market really works for Nigerian, Chadian, Ghanaian, Angolan and other regional crudes.

CITAC examines in depth the operations of this complex market, the forces driving it, the background to the present situation, the outlook for the near futures, and the information tools available with which to understand what is going on.

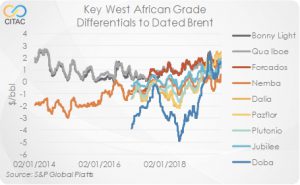

We look at the role of differentials, the relationship to European markets, and especially Dated Brent. We analyse the effects of timing and forward curves on pricing, and lay out how a so-called price is derived from Dated Brent – and how in practical terms the various Brent (or BFOE) markets and the crucial Dated Brent market itself works.

We also look at what price benchmarks are available from price reporting agencies Platts, Argus and ICIS, and also at other price instruments, such as netback prices – values derived from the downstream refined value of the products made from West African crudes.

This is an extract of the Insight Paper published in CITAC’s Sub-Saharan Africa Oil Market Report (October 2019)

Purchase this Industry Insight