CITAC Annual Review of Sub-Saharan Africa’s Downstream Oil Sector 2025

In 2024, SSA oil products demand remained broadly flat for a second consecutive year, declining slightly by 0.8% y/y to 113.9mn mt, down from 114.75mn mt in 2023. While there was a sharp contraction in the biggest markets of South Africa and Nigeria, and other markets on the continent were impacted by inflationary pressures, some markets posted exceptionally strong growth, mainly in countries with high levels of mining activity such as Zambia and Ghana with over 10% y/y increases.

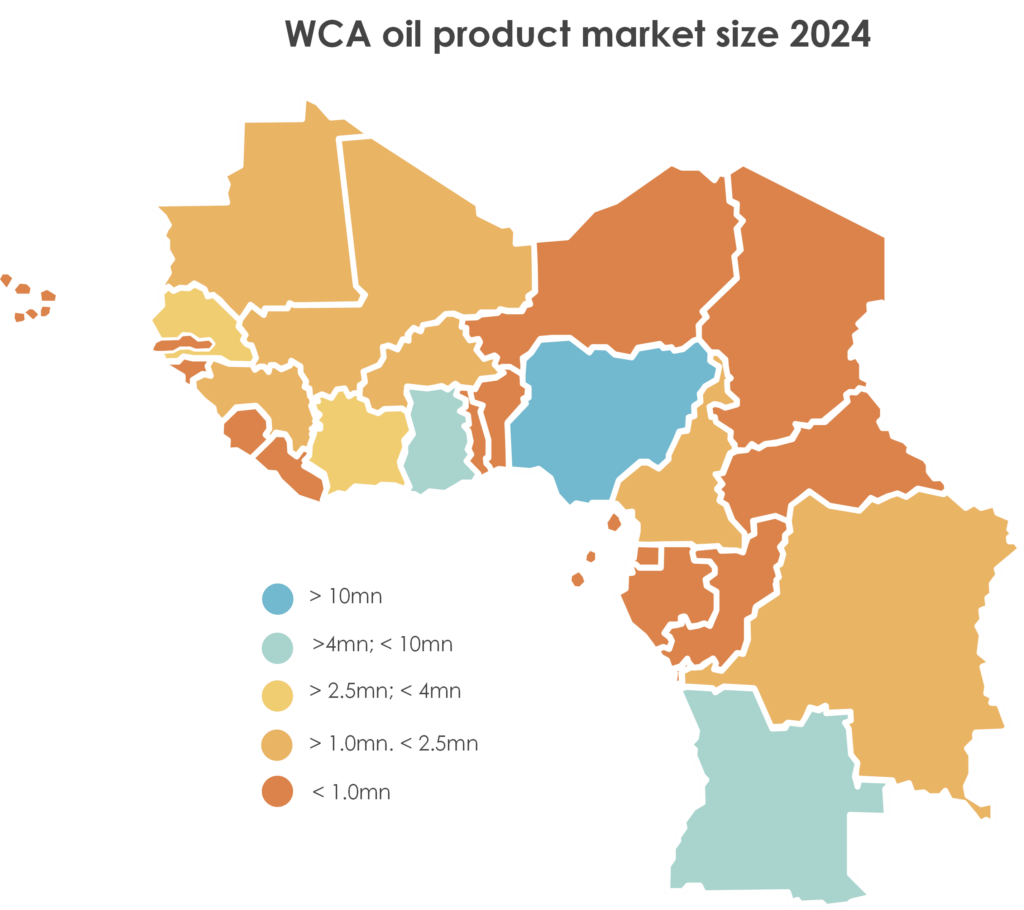

The development of Sub-Saharan African refining in 2024 was marked by a stark divide between the East & Southern (ESA) and West & Central (WCA) regions. The Nigerian market has undergone major product flow changes since mid-2023. The long-awaited 650 kb/d Dangote refinery near Lagos began operations in January 2024, steadily ramping up throughput and streaming secondary units throughout the year. Output from the Dangote refinery has displaced the bulk of international clean products imports in West Africa. In contrast, in ESA, the ongoing civil war in Sudan, the final closure in 2023 of the Indeni refinery in Zambia and the challenges continuing to face South Africa’s refining sector mean that the entire ESA region has only three active refineries, all in one country: South Africa. After recording y/y falls every year from 2017 to 2022 followed by flat performance through 2023, total crude throughput in SSA’s refineries increased by 77.8% y/y in 2024, a phenomenon due primarily to the startup of the Dangote refinery. Crude oil throughput increased from an average of 382.5 kb/d in 2023 to 680.1 kb/d in 2024.

CITAC’s Annual Review of Sub-Saharan Africa’s Downstream Oil Sector 2025 addresses the key trends in the industry: Rapid LPG demand growth, shifting fuel oil supply & demand dynamics, clean product trading flows, the impact of new refining projects, regulation changes as well as detailed expert analysis of future trends.

CITAC Annual Review of Sub-Saharan Africa’s Downstream Oil Sector can be purchased individually. The report is also available at a discounted rate as part of a subscription to our report and retainer services.