CITAC Annual Review of Sub-Saharan Africa’s Downstream Oil Sector 2024

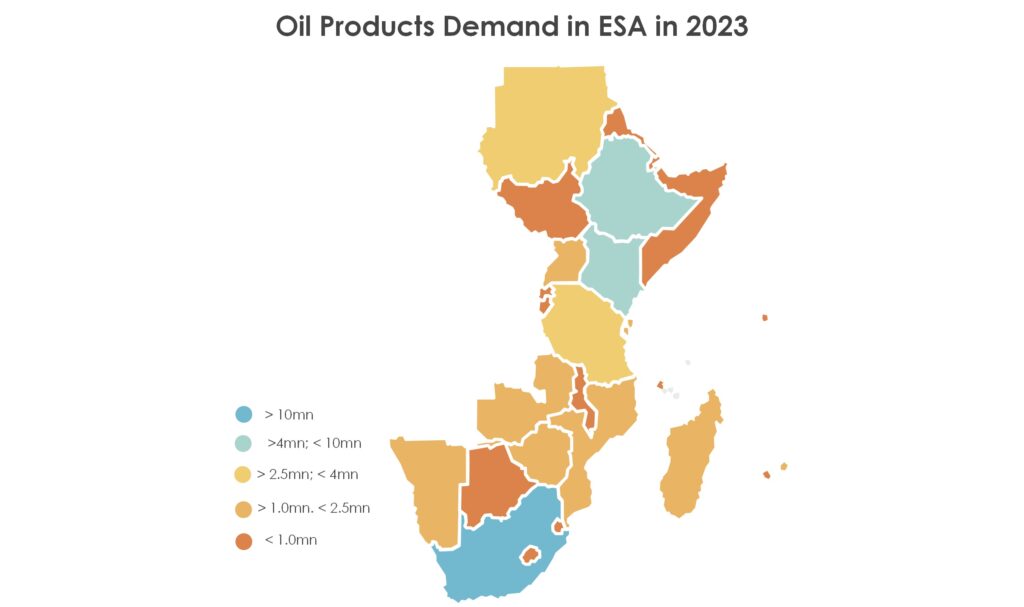

In 2023, oil products demand in Sub-Saharan Africa (SSA) fell by 1.4% y/y to 110mn mt. This overall statistic, however, is the net result of a wide range of factors, including subsidy removal in Nigeria, civil war in Sudan, but also continued robust growth in many markets.

SSA refinery throughput dropped as low as 365 kb/d in Q3 2023 and averaged 470 kb/d in 2023: this is equivalent to one mid-size refinery in the Middle East or Asia. However, the SSA refining sector is undergoing a long-awaited revival, with the commissioning of the 650 kb/d Dangote refinery in Nigeria and the 40 kb/d Sentuo refinery in Ghana, as well as the prospect of a few more small-scale projects coming onstream over the next couple of years (Cabinda in Angola, potential restart of some of NNPC’s idle refining capacity, modular refineries, etc.). Refinery run rates exceeded 600 b/d in April 2024 and are expected to average 732 kb/d this year and exceed 1mn b/d in 2025.

CITAC’s Annual Review of Sub-Saharan Africa’s Downstream Oil Sector 2024 addresses the key trends in the industry: Rapid LPG demand growth, shifting fuel oil supply & demand dynamics, clean product trading flows, the impact of new refining projects, regulation changes as well as detailed expert analysis of future trends.

CITAC Annual Review of Sub-Saharan Africa’s Downstream Oil Sector can be purchased individually. The report is also available at a discounted rate as part of a subscription to our report and retainer services.