LPG uptake strategies in Sub-Saharan Africa

LPG consumption in SSA has experienced tremendous growth over the past 10 years, averaging a compound annual growth rate of 9.6%. Consumption has more than doubled since 2010, reaching 4.0mn mt in 2019. However, total SSA consumption is still dwarfed by North Africa, where the market is significantly more developed.

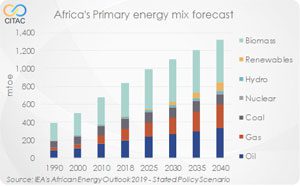

According to the 2019 revision of the United Nations World Population Prospects, world population is estimated to grow by 1.6bn in the next 20 years and nearly half of that will be in Africa, taking the continent’s population to over 2.0bn. It is important to consider the potential effect of this population growth on the continent, which is already struggling to reduce energy poverty. Biomass still makes up a significant part of the energy mix in SSA as wood and charcoal remain the primary cooking fuels of SSA households. If not addressed, this dependency on biomass will only accelerate the deforestation rates currently observed in SSA. In its base case scenario, the International Energy Agency (IEA) forecasts that biomass consumption will continue to increase before it starts to tail off.

Countries have taken diverse approaches to foster their LPG markets in SSA including awareness programmes, subsidies, appliance programmes, educating potential users of the efficiency, cleanliness, environmental and health benefits of using LPG instead of alternatives such as biomass or kerosene.

Subsidies, whether directly to the product itself, or indirectly to bottles and appliances (burners, stoves), have been carried out in some form in at least half of SSA. Ending subsidy policies to competing fuels, such as kerosene, have also taken place, using market economics to encourage consumers to adopt LPG. Other strategies have included infrastructure investments in parts of or in the entire LPG value chain as well as the introduction of cheap supplies, whether by new sources of supply or by better utilisation of wasted resources, e.g. flaring.

This CITAC Industry Insight looks at individual case studies of LPG uptake strategies that have worked in certain SSA countries and why these could serve as inspiration for other countries to develop their own LPG industry. It also provides insights of possible undesirable effects that could arise from certain policies.

This is an extract of the Insight Paper published in CITAC’s Sub-Saharan Africa Oil Market Report (January 2020)

Purchase this Industry Insight